Retirement Planning

In the majority of western countries we have aging populations. Occupational pension schemes are not what they once were, and final salary schemes have become a dying breed. Additionally, many corporate pension schemes are severely underfunded and may not be able to meet their obligations.

Planning towards our future financial independence has never been so vital, and saving on a regular basis is key.

The argument for saving regularly towards retirement

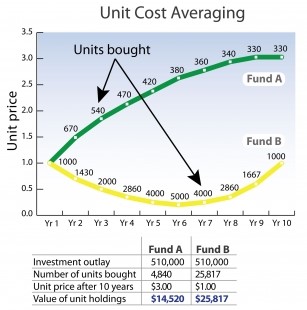

In terms of financial planning, the golden rule in providing for a secure retirement is starting early. By doing this you will benefit from unit cost averaging. Looking at the chart below it would be easy to think that fund A would have achieved the best return. This would have been true if it were a lump sum investment, but because it was instead a regular savings product, fund B actually made more – a lot more. In just 10 years it made three times more than fund A.

For a more detailed overview of the mechanics of ‘unit cost averaging’ please click here.

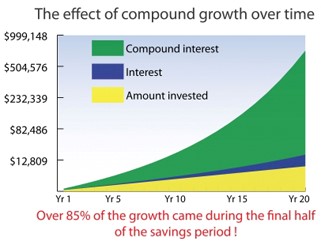

One of the most compelling reasons to save money on a regular basis is not purely because of the benefits of compound averaging. It is also the immense benefit of compound interest, and how it helps build the pension fund through the effect of interest upon interest. The chart below shows how significant this is towards the end of the savings period.

For a more detailed overview of the effect of ‘compound growth’ please click this link.

Questor Capital has business relationships with some of the largest financial institutions in Europe which specialise in many forms of international pensions. Generally speaking, these institutions are placed in low-tax jurisdictions offering the investor an extremely portable, tax-efficient vehicle for longer term financial planning.

Besides the investment vehicle, you also need to understand what income you actually require during retirement. This can be complicated as during the years leading up to retirement you would expect a higher rate of return than in the more conservative years during retirement. Then there is the effect of inflation eroding your purchasing power.